Discussing Art Markets

January 24, 2015

by Diana Greenwald | Filed in: Interdisciplinary

There is a topic that clearly connects economics and the history of art: the art market. While many of papers at Genius for Sale! explored the formative effects that market pressures had on artists in the past, some included studies of art prices over time—most notably Kathryn Graddy’s paper on the predictive value of critic Roger De Piles’ art rankings. Fluctuations in the market and return on investment in art are topics that interest many scholars who work at the intersection of these two disciplines. This website should not neglect research about financial history of art.

Several leads have recently been sent to Arts & Econ about scholarly work in this area. The first is about two researchers—one in France and one in Belgium—that have been publishing a number of interesting papers about the value of investments in art and other collectibles over time. Professor Christophe Spaejners at HEC Paris has written several papers about this topic, including a recent article where he and his co-author explore the investment performance of assets that can be described as “emotional assets.” Spaejners and his co-author describe and calculate the significant costs of transacting in highly-specialized markets for emotional assets, which include art, instruments and collectible stamps. At the Solvay Brussels School of Economics and Management (affiliated with the Université Libre de Bruxelles), Professor of Finance Kim Oosterlinck studies not only monetary history during World War II, but also the advantage of art investment as a hedge during the chaotic wartime years. This is only a small sample of Spaejners’ and Oosterlinck’s many articles in this field.

Of course, many people are also interested in the fluctuations and trends in today’s art market. A reader recently sent in information about Arts & Econ’s near-namesake: Arts Economics. A graduate of Trinity College Dublin’s economics program (which, under the supervision of John O’Hagan, produces many economists interested in Cultural Economics) founded the company in 2005 to advise private and corporate clients about art investment. Arts Economics also publishes a series of reports about the art market around the world—like their impressively detailed TEFAF Art Market Report 2014.

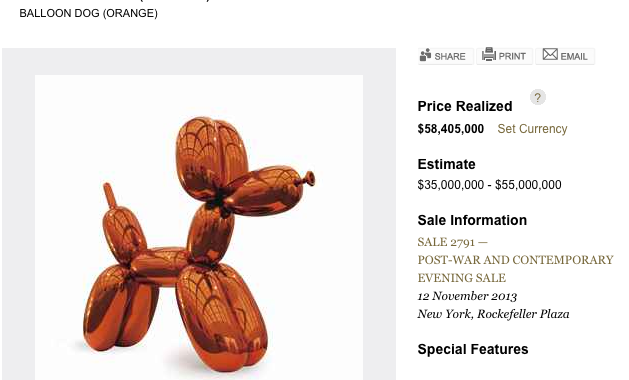

Sometimes there is a resistance among art historians or economic historians to engage with questions or concerns about the contemporary art market, either for the sale of older artworks or for art produced by still-living artists. It is, however, important to remember that today’s transactions are next year’s data. The art market—both past and present—is a necessary condition for this field of study. Without the market, art that is now the focus of scholarly study would have never been created. We may not always be able to predict the magnitude and direction of market forces that make Jeff Koons’ Balloon Dog (Orange) the most expensive work of art by a living artist to be sold at auction, but we should certainly be grateful for them.

The Arts in Science and Nature >>

<< An Exciting Conference in Dublin